We all dream of a secure and comfortable future, whether it’s buying a home, traveling the world, or retiring worry-free. But dreams need fuel, and that fuel is money. Without a solid savings plan, those goals can feel as distant as a mirage in the desert. The good news is that you can save money for the future easily. With the right approach, you can build a safety net and grow your wealth over time.

The key is starting smart. Many people struggle to save because they don’t know where to begin or how to stay consistent. Maybe you’ve tried before, only to lose motivation. That’s why we’ve broken down the best ways to save—simple, practical steps that fit real life. Ready to turn your future plans into reality? Let’s dive in.

Importance of saving money for your future

Saving money for your future helps you stay prepared for whatever life throws your way. It gives you peace of mind, knowing you’re ready for any emergencies, big purchases, or even retirement. Plus, when you save regularly, you are able to build a strong financial foundation for the future.

Here’s why you should save money for your future:

- Safety net for emergencies – If your car breaks down or a medical bill pops up, savings can cover it.

- Freedom to retire comfortably – You won’t have to depend on others when you’re older.

- Big life goals – Want a house, a dream vacation, or to pay for your child’s education? Savings make it possible.

- Less stress, more choices – Money in the bank means you can handle surprises and grab opportunities.

Saving is like planting a seed the sooner you start, the more it grows over time. Even small amounts add up, so take that first step today!

Also Read: Top 10 brilliant money saving tips

What kind of saving goals should you set?

Setting clear savings goals helps you stay focused and makes your efforts more rewarding. Start by identifying what matters most to you—both now and in the future. Short-term goals (1-3 years) could include building an emergency fund for unexpected expenses, saving for a vacation, or setting aside money for a new gadget or car down payment. These smaller targets keep you motivated because you’ll see progress quickly.

For bigger dreams that take longer (4+ years), think about buying a home, funding your child’s education, or securing a comfortable retirement. Breaking these into smaller, manageable steps makes them feel less overwhelming. For example, instead of stressing over a huge retirement number, focus on saving a little each month to save money for the future consistently. The key is to stay disciplined while adapting as your priorities evolve over time.

The main point is to balance immediate needs with future plans. Start with what’s most important to you, set realistic timelines, and then adjust as life changes. Every bit you save today brings you closer to the future you want.

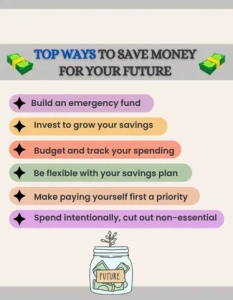

Top ways to save money for your future

Listed below are some of the most practical ways that you can follow to save money for the future. Continue reading to learn and to leverage them for your benefit.

1. Budget and track your spending

Want to save money? First, you need to know where your money is going. Try writing down everything you spend for one month – from big bills to small snacks. You might be surprised when and where your cash disappears!

Once you see your spending patterns, make a basic budget. Divide your money into three parts:

- Must-pay bills (rent, electricity, groceries)

- Fun money (eating out, movies)

- Savings

Look for easy cuts first. That gym membership you never use? The food delivery apps you order from too often? These small leaks can drain your wallet without you noticing.

Here’s how it works:

Rahul noticed he was spending ₹300 every workday on lunch and coffee. By bringing homemade meals just 3 days a week, he saved ₹3,600 every month. That’s ₹43,200 in a year – enough for a nice family holiday!

Remember, you don’t need to cut all fun spending. Just being aware helps you spend smarter and save more.

2. Spend intentionally, cut out non essentials

Saving money doesn’t mean saying no to everything you enjoy. It’s about choosing what’s truly important to you and skipping the rest. Think of it like cleaning your closet – you keep what you love and use, donate what just takes up space.

Start by asking yourself before every purchase:

- Do I really need this?

- Will I use it often?

- Does it add value to my life?

You might find many things you spend on that don’t actually make you happier. That daily ₹250 coffee? Maybe having it just twice a week would be just as nice. Those three streaming services? Keep your favorite, cancel the others.

Real change happens when…

Neha loved eating out but noticed she often didn’t enjoy the meals much. She decided to only eat out for special occasions, saving ₹8,000/month. Now she enjoys better meals on weekends and has extra money for her dream European trip.

Remember: It’s not about cutting all fun. It’s about spending on what truly matters to you. When you do this, saving happens naturally, without feeling like you’re missing out.

3. Make paying yourself first a priority

Saving money should be your first financial priority, not an afterthought. Just like you automatically pay bills, your savings deserve the same treatment. This simple shift in thinking can transform your financial future.

The easiest way? Set up automatic transfers to move money to savings as soon as you get paid. Start small if needed – even ₹500 per paycheck makes a difference. You’ll be surprised how quickly you adapt to spending less, and how fast your savings grow when you’re consistent.

Take Priya’s example:

She started with automatic transfers of ₹2,000 from each paycheck. At first, she worried it might be too much. But within months, she didn’t miss the money. After one year, she had ₹48,000 saved without any stress. This became her emergency fund, protecting her from unexpected expenses.

The best part? This method works for any goal – vacations, a new phone, or retirement. Your future self will thank you for making savings a non-negotiable habit today. Remember, when you pay yourself first, you’re investing in your own financial freedom.

4. Invest to grow your savings

Just keeping money in the bank isn’t enough these days. Prices keep rising (that’s inflation), so your savings actually lose value over time. Investing helps your money grow faster than inflation and mutual funds are the most sought after and practical investment method in India. People are leveraging it to build wealth in the long term.

You don’t need to be rich to start. Even small amounts, invested regularly, can become big sums over time. Think of it like planting a tree – the earlier you start, the more it grows.

All investments have some risk associated with them, but staying invested for 5+ years usually gives good returns. The longer you stay, the more your money can grow through compounding (where your earnings start earning interest too).

Riya’s story shows how this works:

She invested just ₹5,000 every month in mutual funds. After 5 years, her ₹3 lakh grew to ₹4.2 lakh – that’s ₹1.2 lakh extra! In a savings account, she would have earned much less.

5. Be flexible with your savings plan

Life changes, and so should your savings strategy. What worked last year might not fit today. You should regularly check your savings goals to match your current needs. This keeps your plan realistic and therefore achievable.

Don’t stress if you need to adjust amounts or timelines. Maybe you got a raise – save more. Had unexpected expenses? It’s okay to save less temporarily. The key is staying consistent while being practical.

Example: When Rohan switched jobs, he reduced investments for 3 months to handle moving costs. Later, he increased his savings again. Flexibility helped him stay on track without financial stress.

Remember: Perfect consistency isn’t the goal. Adapting wisely is what builds long-term savings success.

6. Build an emergency fund

Life throws surprises – and some of them are way too expensive. An emergency fund acts as your financial safety net. Start by saving enough to cover 3-6 months of living expenses. This protects you in the event of unexpected job loss or medical emergencies.

You need to keep this money separate from regular savings. A savings account works best – easy to access but hard to spend impulsively. Additionally, you can consider short-term debt mutual funds for emergency savings. Even small, regular contributions add up over time.

Example: When Meena’s scooter needed urgent repairs, her ₹50,000 emergency fund saved her from debt. She rebuilt the fund by saving ₹3,000 monthly afterward. Peace of mind matters!

Conclusion

Saving money for the future is easier than you think. Just take it step by step. Begin by tracking your spending, then focus on what’s important and save the rest. Even small amounts, set aside automatically each month, can grow into something big over time.

Life will change, and that’s fine—just adjust your savings as needed and keep going. Remember Riya? She turned ₹3 lakh into ₹4.2 lakh by staying consistent. You can do it too! The best time to save money for the future is today. Start where you are, keep it simple, and stay patient. One day, you’ll look back and thank yourself for taking that first step. Your future is worth it!

Related Topics: 5 Best Investment Options In India 2025

Follow Us: