Are you struggling with money management? You’re not alone. A significant number of people find budgeting and keeping record of their spendings overwhelming. According to a stat, 79% of young adults have never created a budget and 72% of households lack a written financial plan.

However, there is a popular budgeting method, introduced by Senator Elizabeth Warren, which makes sure you cover your essentials while still enjoying life. It is the 50/30/20 budget rule.

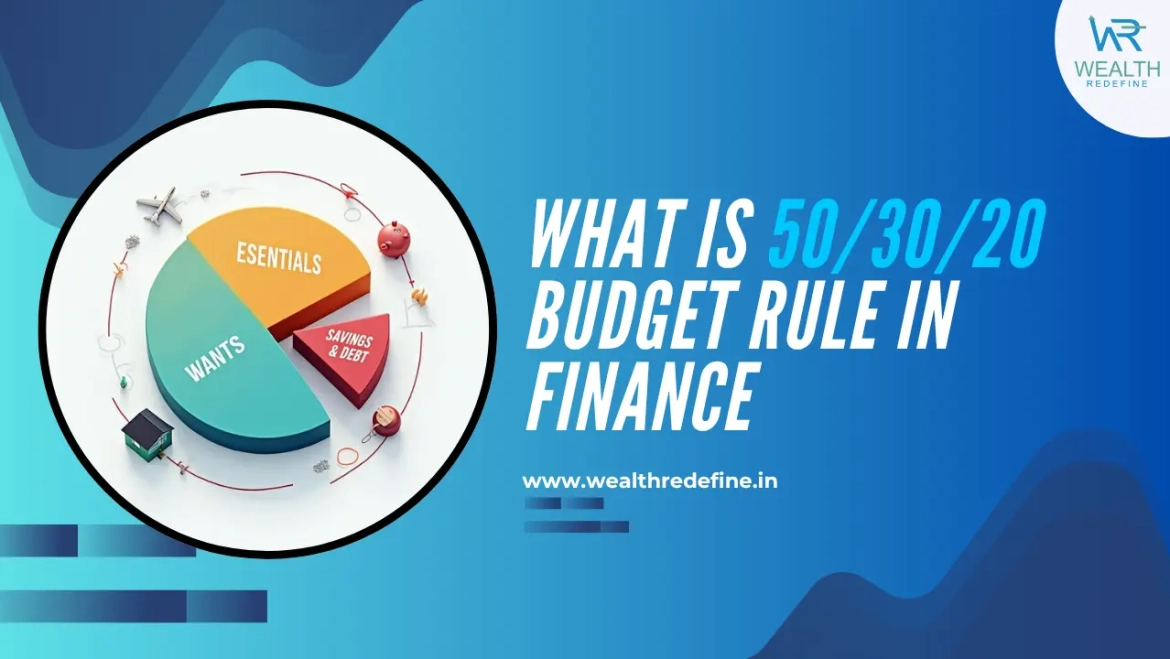

It aims to split your income into three categories, namely needs, wants, and savings. To employ this budgeting principle effectively, you don’t need to be a finance expert or make any complex calculations. It is one of the most straightforward ways to take control of your finances.

Whether you’re saving for a dream vacation or paying off loans, this budgeting rule helps you balance spending and saving—without any stress. Keep reading to learn about this rule in detail and how you can adopt it in your life.

What is the 50/30/20 budget rule?

The 50/30/20 budget rule simplifies budgeting by dividing your after-tax income into three parts: 50% for needs (rent, groceries), 30% for wants (dining out, hobbies), and 20% for savings or debt payoff. It’s flexible, practical, and helps you balance spending while securing your future.

50%: Needs

We all have basic things we absolutely need to live our lives, right? These are called “needs” – stuff like a roof over your head (rent or mortgage), food, groceries, electricity to power your home, transportation to get to work or school, and important bills like insurance or loan payments. The 50/30/20 rule says you should spend no more than half of the money you take home after taxes on these necessary expenses.

Sometimes it’s easy to confuse things we want with things we actually need. For example, while having a phone might be necessary, paying for the most expensive data plan isn’t.

If you find yourself spending more than 50% of your income on needs, you might need to look for ways to reduce these costs. This could mean finding cheaper grocery options, using public transportation instead of owning a car, or moving to a more affordable home.

The important thing is to keep your necessary expenses at or below that 50% mark so you’ll have money left for other important things in life.

30%: Wants

Now let’s talk about the fun part – wants! These are things that make life more enjoyable but aren’t essential for our survival. Think movie nights, vacations, new gadgets, or eating at restaurants. The 50/30/20 budget rule suggests that you should not spend more than 30% of your income on these pleasures.

The tricky part? Wants can easily get out of control in our “treat yourself” culture. That new phone or designer shoes might feel necessary, but they’re really just so nice-to-haves. A good trick is to wait a couple of days before buying – often, the urge passes.

Smart spending on your wants means being intentional. You can create a “shopping fund” where you save for your special purchases instead of buying it on EMI.

Before making the final decision, you need to compare the prices, look for deals, and ask yourself: “Will this really make me happier in the long-term?” This way, you enjoy life while staying financially healthy.

20%: Savings

The final piece of the 50/30/20 rule is all about your future. After covering needs and wants, this 20% is for building financial security. Think of it as paying yourself first – money that will grow over time to protect and support you later in life.

This portion should go toward both savings and smart investments. You might put some in an emergency fund, retirement account, or other investments like stocks or mutual funds. Treat this 20% as untouchable for daily spending – it’s not extra cash for wants, but your foundation for financial freedom.

Starting early makes all the difference, thanks to compound interest. Even small amounts saved regularly can grow surprisingly large over time. Whether it’s 500 or 2000, consistently setting aside this 20% creates habits that lead to lasting wealth and peace of mind.

Benefits of the 50 – 30 – 20 Budget Rule

The 50/30/20 budgeting rule can guide individuals and common people just like you and me to financial prosperity in multiple ways. Let’s have a look at the potential advantages of this budgeting rule:

1. Simple to use

As already stated, this budgeting principle is the most simple and straightforward way to take care of your finances and to deal with your future financial situations. What it does is it distributes your income or salary into three categories without you having to understand any financial jargon or to perform any complex calculations.

2. Provides a safety net

The 50/30/20 rule automatically builds financial security by preserving 20% of your income for savings. This creates your personal safety net for emergencies like job loss or medical bills. This way, you’ll sleep better knowing you’re prepared for upcoming life’s surprises.

Additionally, consistent savings grow into long-term protection. Over time, that 20% becomes your freedom fund for opportunities or tough times. It’s like giving the future-you a financial hug with every paycheck.

3. Improve your financial awareness

The 50/30/20 budget rule trains you to see money differently. Suddenly, you’ll notice where every dollar goes – whether it’s for essentials, fun, or your future. This awareness helps you spot wasteful spending and make smarter choices naturally.

As you track your 20% savings monthly, you’ll become curious about growing it. You’ll start learning about emergency funds, investments, and retirement options.

4. Balances your spendings

The 50/30/20 rule gives your money clear boundaries, so you never overspend blindly. By dividing your income into needs, wants, and savings, you automatically create a spending balance that feels fair and sustainable. No more guilt about treats or stress about bills!

Plus, these percentages act like guardrails for your finances. If one category grows too big, you’ll notice quickly and can adjust. This simple system keeps your spending in harmony while still letting you enjoy life.

5. Minimizes your financial strain

The 50/30/20 budget rule acts like a stress-reliever for your wallet. By automatically setting aside 20% for savings, you’re building a cushion for life’s surprises. No more panicking when unexpected expenses pop up!

Plus, knowing your needs (50%) and wants (30%) are covered brings peace of mind. You’ll worry less about money because everything has its place. This simple system keeps financial headaches at bay while securing your future.

How can you adopt the 50-30-20 budget rule?

Tracking your budget is not a one size fits all system. However, you can follow this simplified tips on adopting a 50/30/20 budget rule which is relevant to nearly all individuals:

1. Track Your Expenses

Start by recording every rupee you spend for a month – yes, even that morning chai! This shows exactly where your money goes, helping you spot patterns. Also, you can use a simple notebook, budgeting app, or spreadsheet to categorize each expense as a need, want, or saving. You’ll quickly see how close (or far) you are from the ideal 50/30/20 split, revealing what needs adjustment.

2. Understand Your Income

Firstly you need to clearly understand your income. Your income is what you receive in your bank account after taxes and deductions. That is your real spending power and that is what matters for budgeting not your salary before cuts. This number becomes your foundation for dividing into needs, wants, and savings.

3. Identify Your Critical Costs

These are your must-pay expenses – rent, groceries, utilities, and minimum debt payments. They’re the non-negotiables that keep your life running smoothly. Since they typically eat up half your budget, review them carefully. While you can’t eliminate these, you might find ways to reduce them through smarter choices.

4. Automate Your Savings

Make saving effortless by setting up automatic transfers right after payday. This “set-and-forget” approach makes sure your 20% savings happens before you can spend it. Your bank can move money to savings or investment funds automatically, so you’ll grow wealth without willpower. Plus, you’ll never accidentally overspend what should be saved.

5. Maintain Consistency

Stick with your 50/30/20 budget rule like your favorite weekly routine – it gets easier with time. Some months will test your willpower, but staying consistent builds powerful money habits. Treat your budget percentages like friendly boundaries, not strict rules. Regular check-ins help you adjust while keeping you on track long-term.

Conclusion

Life often throws unexpected expenses at us, and therefore, you should always be prepared to tackle them effectively without reaching out to your credit card. I can understand that saving is difficult, but this 50/30/20 budget rule simplifies it like learning one, two, three. It provides you with a blueprint on how to manage your income effectively.

With this budgeting plan in hand, tracking your spending becomes seamless. To build a good financial future, you’ll have to find ways to minimize some unnecessary expenses and direct them to investment purposes like mutual funds and retirement plans.

Living a life like a Spartan is not what I meant, but, eventually, you need to stick to a financial plan or budget to save for those golden years of retirement while enjoying the activities that make you happy.